One question we are asked nearly every week is: I have full coverage, why won’t my insurance company pay for my injuries?

A common misconception is that “full coverage” insurance means that your policy includes all possible coverages that an insurance company offers. Often times, “full coverage” simply means that your policy has what is required by the state of Texas. All drivers are required to carry bodily injury liability insurance with a minimum coverage amount of $30,000 per person and $60,000 per accident to help pay for injuries and $25,000 per incident for property damages if you cause a car accident. It is often referred to as 30/60/25 coverage.

But what happens if you are seriously hurt in an accident caused by someone else and they have little or no insurance? Unless you have Uninsured/Underinsured motorist (UM/UIM) coverage, you may be out of luck.

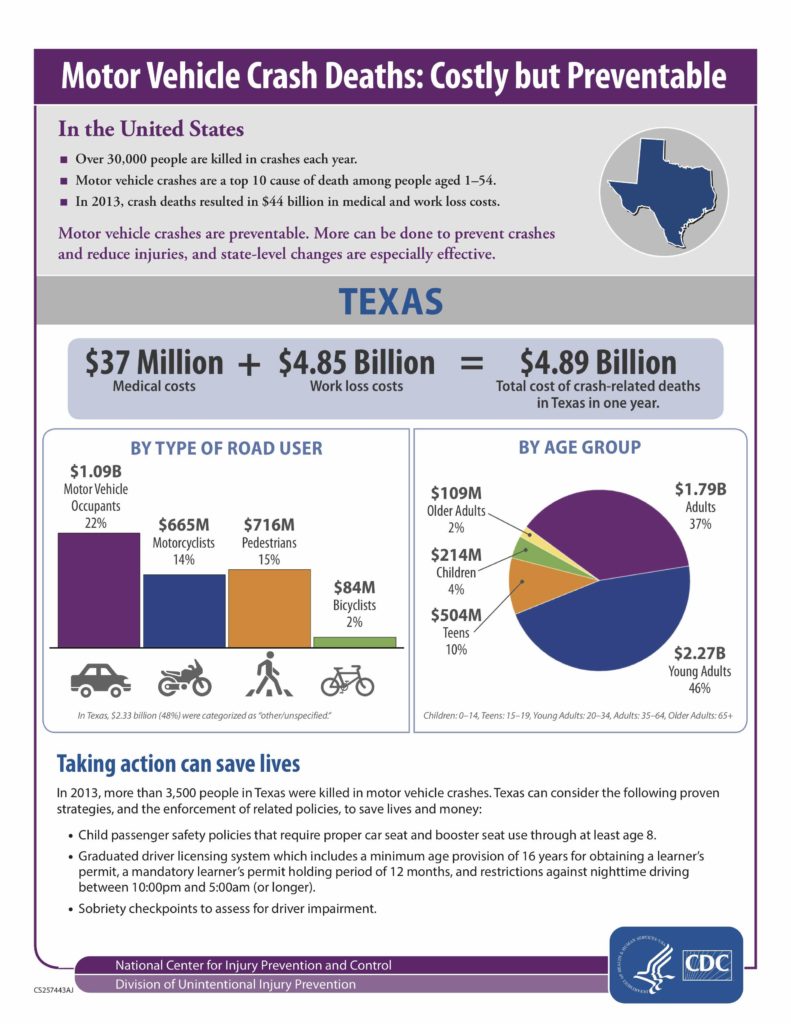

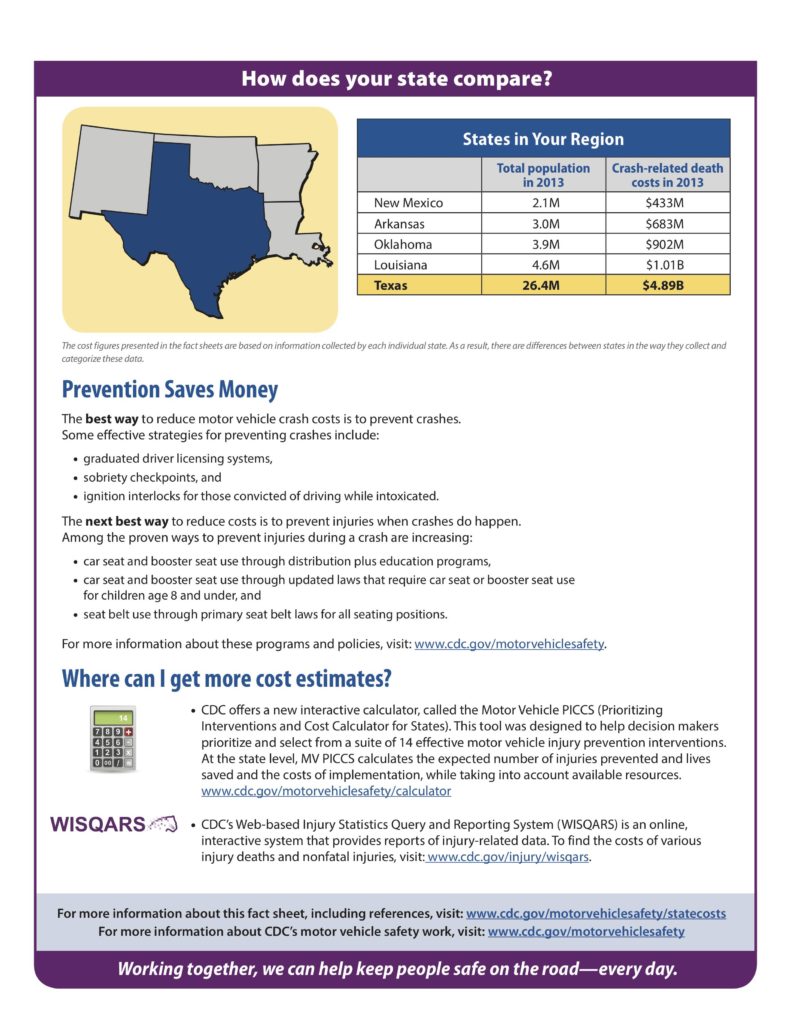

UM/UIM coverage kicks in when the person who caused the accident has too little or no insurance at all to cover your injuries, your lost wages, future medical bills, and pain and suffering. As you can see from this chart, accidents are extremely expensive and even an ambulance ride and emergency room stay alone can cost well over the minimum policy limits. If you have UM/UIM coverage, you won’t have to worry about having enough money to cover those costs since your insurance company will pick up what the at-fault company did not.

How do I know if I have UM/UIM coverage and do I have enough?

Every policy is different, but we recommend that everyone have at least $100,000 per person and $300,000 per accident in coverage. The cost is very minimal – less than $10 per month in most cases – and our office offers policy reviews completely free of charge. Simply call us at 713-904-1765 to set up a quick, 15-min review of the policy. All we need is your declarations page and we’ll be able to make suggestions on how to protect your family.